Marketplace Pulse: In Through the Out Door

The Marketplace Pulse series provides expert insights on timely policy topics related to the health insurance marketplaces. The series, authored by RWJF Senior Policy Adviser Katherine Hempstead, analyzes changes in the individual market; shifting carrier trends; nationwide insurance data; and more to help states, researchers, and policymakers better understand the pulse of the marketplace.

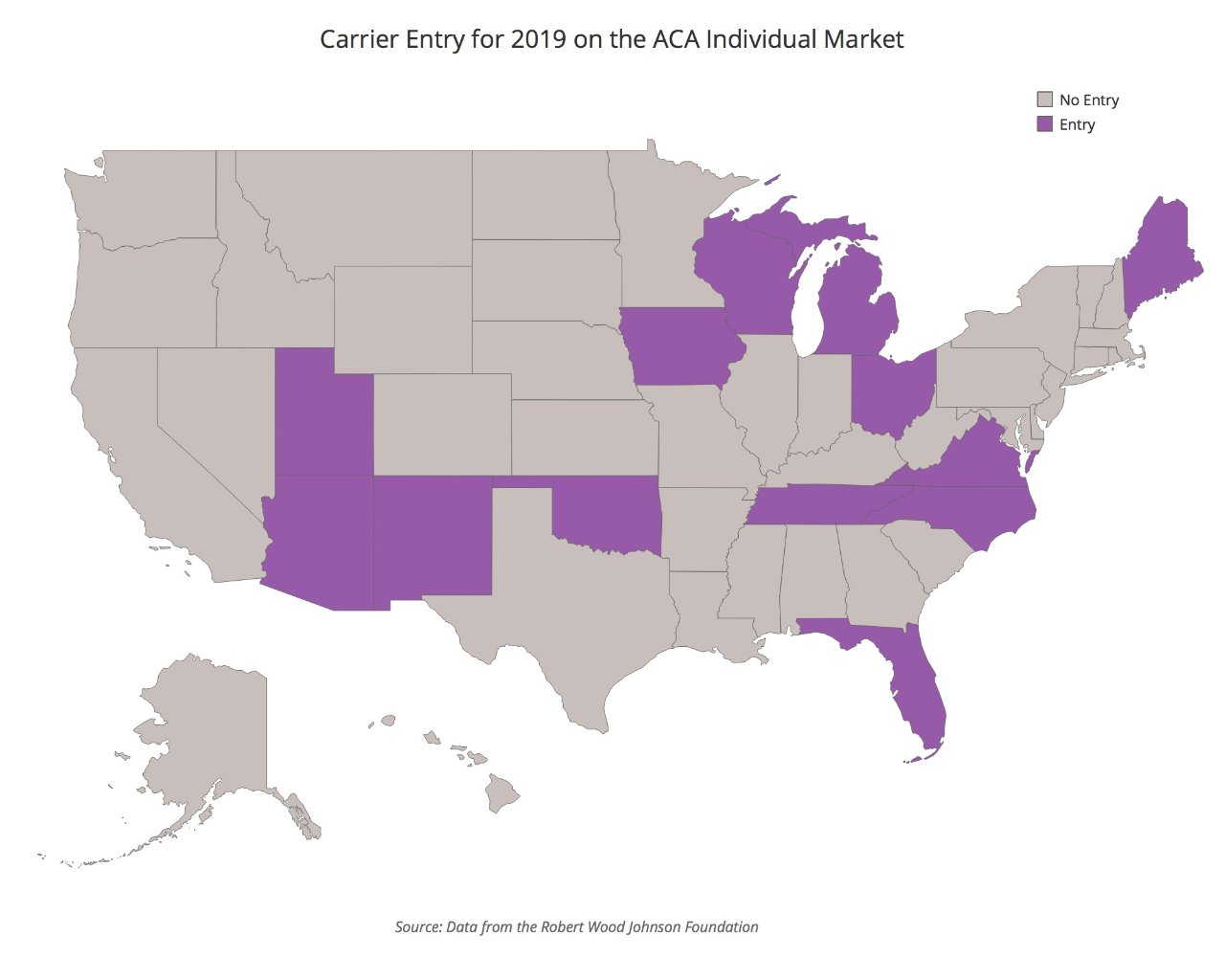

A year ago, rate filings caused widespread anxiety, as multiple carriers announced withdrawals from the ACA market, and state officials struggled to fill bare counties. Many of those remaining filed enormous rate increases. In 2018, marketplace enrollment was stable, while unsubsidized enrollment continued its multi-year decline. So far, this year’s rate filing season has been sprinkled with news of entry and expansion, and proposed rate hikes that are generally more moderate. With no announced market exits thus far, it seems likely that in 2019 there will be net entry into the ACA marketplace.

Favorable financial results for participating carriers is clearly the motivating factor, along with a continuation of the silver-loading policy that has created a relatively stable atmosphere for the subsidized part of the market. It’s possible that, at least in some markets, the marketplace population has become less costly to serve over time. It may be that the market is reaching the end of a multi-year “Goldilocks Process,” characterized by initially too many market participants, then too few, now perhaps closer to an amount that is “just right," although this remains to be seen.

One thing that seems certain is that the focus of most carriers in the marketplace will be on the subsidized customer. The unsubsidized share will continue to be challenging, particularly in light of the elimination of the mandate and the prospect of short term and association health plans. Exit from the off exchange only segment by carriers has been significant, and this trend seems unlikely to reverse. Given this, barring large increases in enrollment, there is the distinct likelihood that we will see more carriers serving the same or fewer customers in 2019, making it likely that margins will be tighter.

The opportunities for expansion are clearly not infinite. To succeed, carriers need to identify areas with access to competitive provider markets and a population that can create a sufficient scale for profitability. As we have seen so far, this puts urban parts of rural states in play, as well as other underserved urban areas. While Medicaid Managed Care Organizations (MMCOs) dominated the little entry that occurred into the marketplace in 2018, there are a wider range of entrants so far in 2019, including Oscar, Bright Health, Medica, Wellmark, and potentially Anthem, in addition to MCOs such as Centene, Molina, and Virginia Premiere.

Our public web tool tracks participation for 2019 at the county level. It can be used to monitor changes in the number of carriers by counties, and also provides information at the carrier level. Data can also be downloaded.

The tool can be used to track exits and entries, although so far there have been no exits—a stark contrast to last year. While final contracts are still several months away, evidence suggests that carrier interest in the ACA marketplace is definitely on the rise.

Related Content

Variations Among States in Federally-Facilitated Markets

High Deductibles Make Bronze and Gold Plans More Affordable